How it works

What we do

Commercial property insurance doesn’t always come cheap. Find out how we can help you fight denied, delayed or underpaid claims.

Why us?

We fight for you

Our team has the resources, experience, and legal firepower to give you the best representation possible.

Contingency Basis

No-risk guarantee

We take all cases on a “contingency-fee” basis – meaning no upfront cost to our clients. Unless we produce results, you won’t owe us a dime.

FAQ

Know your rights

Insurance companies are getting tougher and tougher. We’re here to help you stay ahead of the game.

Whether your insurance claim was denied, delayed, or underpaid, we’ll get you the settlement you deserve.

Types Of Claims We Handle

Roofs, windows, automobiles

Property fall victim to exterior hail damage? Repairing your roof & other assets may be covered.

Get moving again

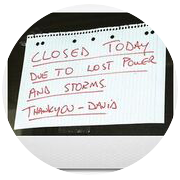

Had to suspend operations due to natural disaster? You may be entitled to recover business interruption damages.

Wind or heavy rain damage

Resuming operations after a hurricane or other disaster can get messy. A collapsed roof can render your business completely inoperable – we’re here to help.

Post-storm recuperation

Mindiola Law Firm will help you pick up the pieces after a hurricane and get your life moving again.

High wind speeds

Wind can often cause the most severe damage during tropical storms and hurricanes. We’ll help you discern wind damage from previous structural wear and tear.

Structural damage

Storms can bring record levels of flooding and water damage to texas. Let us help you navigate the waters post-flood.

Repair & rebuild

We understand the devastating losses you, your business or your family may have suffered due to tornado damage.

Restoration, smoke & soot cleanup

Insurance companies often claim properties were in poor condition before the damage occurred. Let us help you fight these claims.

Billion

U.S. property damage

due to fires in 2019

Billion

ANNUAL U.S. PROPERTIES

AFFECTED BY HAIL

Billion

Cost of 1 week of economic inactivity

in Houston due to severe storm

Unexpected wind damage can cost you a fortune

Even a minor wind storm can cause a serious threat to your small or large commercial operation.

Hail can be devastating to your business

If a commercial insurer has disputed, delayed, or denied your hail damage claim, you need an experienced hail damage attorney to fight for you.

TYPES OF PROPERTIES WE PROTECT

Frequently Asked Questions

WHAT IS FIRST-PARTY INSURANCE?

If you have an insurance policy, you may have questions about the differences between “first-party” and “third-party” insurance. These terms may appear in your insurance policy contract. An insurance policy is a contract between you, the insured, and an insurance company, the insurer.

When an insured, the first party, receives payment from an insurer, the second party, when an accident loss, accident or injury is caused—either by the policy owner or a third party—this is first-party insurance in action.

Depending on the location of your property, you might be required to select specialty insurance coverage in the event of a natural disaster. For instance, a lender might require the property owner in a flood zone to carry flood insurance. A property owner on an active fault line may select earthquake insurance.

DOES THE POLICYHOLDER HAVE REMEDIES AGAINST THE INSURANCE COMPANY WHEN IT ACTS IN BAD FAITH?

Yes. When the insured submits a claim to the insurer and the insurer doesn’t uphold its contractual bargain with the insured, it’s possible to take legal action. An experienced bad faith insurance lawyer will work with you to hold the insurance company accountable.

With legal counsel at your side, the insurer will have few valid arguments for late payout or outright denial of your claim.

WHAT’S THE INSURANCE COMPANY’S DUTY?

Find out now if the insurer has violated its duty to you. Contact the first-party insurance claim team at Mindiola Law Firm now. We will analyze the insurance policy, assess the facts, and determine if you have a viable bad faith claim (or other claim) against the insurer.

The law protects the first party from abusive insurance companies. It penalizes insurers that engage in bad faith practices. Many first parties don’t file a claim because they’re concerned about loss of insurance coverage or the stress of going to war with a large financial institution.

If you believe an insurance company has treated you unfairly, it probably has. It’s common to experience frustration when the insurer delays or plays games to lessen or eradicate its financial obligation to you.

Insurance law varies between the states, so you need an expert bad faith law firm to provide expert advice. Sometimes, the threat of litigation will prompt the insurance company to straighten up.

Find out now if the insurer has violated its duty to you. Contact the first-party insurance claim team at Mindiola Law Firm now. We will analyze the insurance policy, assess the facts, and determine if you have a viable bad faith claim (or other claim) against the insurer.

WHY SHOULD I CONTACT A FIRST-PARTY INSURANCE CLAIM LAW FIRM?

You need expert advice. Insurance companies have access to expert legal advice, and so should you.

Don’t assume that because you paid for an insurance policy that the insurer will pay the claim in full. The insurer is focused on the bottom line. All insurers are in the business of taking in premium income and most do everything possible to minimize (or deny) insureds’ claims.

Insurance laws are complex. The documentation and proof required to show the court that your claim was unfairly delayed or denied can be extraordinary.

Unfortunately, insurers hope that denying or stalling a claim will prompt the insured to settle for less money than it owes.

First-party insurance claimants have the right to file a lawsuit against insurers acting in bad faith. Take action now with a free consultation at .

Get answers to common questions about first-party insurance.

We don’t get paid unless we get you results

Testimonials from clients

My property was unfortunately damaged in a hail storm. Despite routinely paying premiums for coverage, my insurance company was no help. I hired Mr. Mindiola and was more than satisfied with the payment he garnered. I’d recommend his firm to anyone in a similar circumstance seeking help.

After a horrible storm and my insurance company not dealing fair with me, the Mindiola Law Firm fought back on my behalf. Not only were they professional and guided me through the process, but we recovered the money I needed to repair my property.